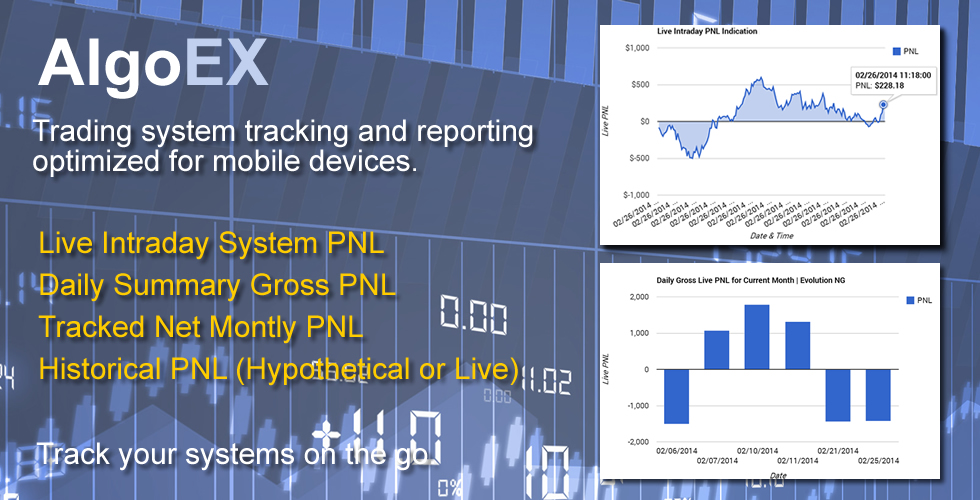

Welcome to the AlgoExchange, a web app for trading system reporting, tracking and trading optimized for mobile devices.

Track System Results

Track the trading results of a wide variety of trading systems across global markets in near real time.

Review Historical Performance

Review historical performance, generated on historical data, from tracked data or from live trading.

Watch Live Trades

Monitor live PNL charts generated from today’s trades updated every minute.

Trade in Your Account

Select systems to trade live in your personal trading account.

Browse Systems Now

Click the icon above to see what’s trading now or check out the list below.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURES RESULTS. The results below are are either hypothetical or actual, as indicated in the “P&L Type” column. Tap on the Developer or System Name for charts and stats. Sort by any column by tapping on that column. See hypothetical disclaimer and performance disclosures below or tap on column headings for more information.

| Developer | Program | MTD | YTD | 2025 | Max DD | Current DD | P&L Type | Acct Min | Mo. Fee | Comm |

|---|---|---|---|---|---|---|---|---|---|---|

| SIF | X4 | 0.03% | 0.03% | 31.78% | -33.05% | 0.00% | Actual Sys | $25,000 | $100 | $16 |

| Prime Market Signal | NQES Spread | 3.14% | 3.14% | 7.13% | -36.19% | -7.12% | Actual Sys | $20,000 | $25 | $10 |

| Roe Capital Management | Statera MR | 3.08% | 3.08% | 12.59% | -19.70% | 0.00% | Actual CTA | $100,000 | $0 | $10 |

| Prime Market Signal | Super Index | 6.84% | 6.84% | 7.26% | -61.17% | -12.00% | Actual Sys | $50,000 | $25 | $5 |

| Roe Capital Portfolios | Statera + ITOT | 2.70% | 2.70% | 14.72% | -12.87% | 0.00% | Hypothetical Portfolio | $200,000 | $0 | $10 |

| SIF | Spreads Micro | -7.46% | -7.46% | 16.55% | -39.49% | -25.55% | Actual Sys | $50,000 | $50 | $3 |

| Target Alpha | Opus BTC | 0.00% | 0.00% | -4.52% | -36.76% | -16.32% | Actual Sys | $30,000 | $30 | $3 |

| SIF | X4+iTOT | 1.19% | 1.19% | 24.40% | -14.82% | 0.00% | Hypothetical Portfolio | $200,000 | $0 | $10 |

| Roe Capital Management | TEP Portfolio | 4.16% | 4.16% | 1.67% | -13.98% | 0.00% | Actual CTA | $200,000 | $0 | $10 |

| SIF | EOD | 3.42% | 3.42% | 8.22% | -20.73% | -1.82% | Actual Sys | $50,000 | $50 | $15 |

| SIF | Spreads II | -8.32% | -8.32% | 12.14% | -35.61% | -25.02% | Actual Sys | $50,000 | $150 | $3 |

| SIF | Spreads Jr. 2.0 | -1.21% | -1.21% | -1.67% | -23.55% | -17.67% | Actual Sys | $10,000 | $20 | $4 |

| Capstone | P2 | 2.18% | 2.18% | 45.17% | -6.48% | 0.00% | Actual Sys | $100,000 | $150 | $25 |

| SIF | Spreads Jr. 1.0 | -2.63% | -2.63% | 20.45% | -16.37% | -2.63% | Actual Sys | $10,000 | $20 | $4 |

| SIF | Spreads Jr. Combined | -1.92% | -1.92% | 9.39% | -16.07% | -7.83% | Actual Sys | $20,000 | $40 | $4 |

| Capstone | P57 | -3.40% | -3.40% | 1.22% | -5.63% | -5.63% | Actual Sys | $1,000,000 | $833 | $18 |

| SIF + Capstone | X4 + P2 | 0.50% | 0.50% | 32.59% | -0.47% | 0.00% | Hypothetical Portfolio | $250,000 | $300 | $13 |

Contact Us | Risk Disclosures | Understanding AlgoEx Data

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM.

ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL OF WHICH CAN ADVERSELY AFFECT ACTUAL TRADING RESULTS.

For any results which are composites of two or more systems or programs, please be aware of the following:

THIS COMPOSITE PERFORMANCE RECORD IS HYPOTHETICAL AND THESE TRADING ADVISORS HAVE NOT TRADED TOGETHER IN THE MANNER SHOWN IN THE COMPOSITE. HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY MULTI-ADVISOR MANAGED ACCOUNT OR POOL WILL OR IS LIKELY TO ACHIEVE A COMPOSITE PERFORMANCE RECORD SIMILAR TO THAT SHOWN. IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN A HYPOTHETICAL COMPOSITE PERFORMANCE RECORD AND THE ACTUAL RECORD SUBSEQUENTLY ACHIEVED.

ONE OF THE LIMITATIONS OF A HYPOTHETICAL COMPOSITE PERFORMANCE RECORD IS THAT DECISIONS RELATING TO THE SELECTION OF TRADING ADVISORS AND THE ALLOCATION OF ASSETS AMONG THOSE TRADING ADVISORS WERE MADE WITH THE BENEFIT OF HINDSIGHT BASED UPON THE HISTORICAL RATES OF RETURN OF THE SELECTED TRADING ADVISORS. THEREFORE, COMPOSITE PERFORMANCE RECORDS INVARIABLY SHOW POSITIVE RATES OF RETURN. ANOTHER INHERENT LIMITATION ON THESE RESULTS IS THAT THE ALLOCATION DECISIONS REFLECTED IN THE PERFORMANCE RECORD WERE NOT MADE UNDER ACTUAL MARKET CONDITIONS AND, THEREFORE, CANNOT COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK IN ACTUAL TRADING. FURTHERMORE, THE COMPOSITE PERFORMANCE RECORD MAY BE DISTORTED BECAUSE THE ALLOCATION OF ASSETS CHANGES FROM TIME TO TIME AND THESE ADJUSTMENTS ARE NOT REFLECTED IN THE COMPOSITE.

IMPORTANT RISK FACTORS AND PERFORMANCE DISCLOSURES

THE RISK OF LOSS IN TRADING COMMODITY FUTURES AND OPTIONS CAN BE SUBSTANTIAL AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prior to purchasing or leasing a trading system from this or any other system vendor or investing in a trading system with a registered commodity trading representative, investors need to carefully consider whether such trading is suitable for them in light of their own specific financial condition. In some cases, futures accounts are subject to substantial charges for commission, management, incentive or advisory fees. It may be necessary for accounts subject to these charges to make substantial trading profits to avoid depletion or exhaustion of their assets. In addition, one should carefully study the accompanying prospectus, account forms, disclosure documents and/or risk disclosure statements required by the CFTC or NFA, which are provided directly by the system vendor, CTAs and/or the broker carrying your account. Past performance is not necessarily indicative of future results.

Important Information About this Trading System Analysis

Unless otherwise specified, the table above represents the summation of either hypothetical or actual trades based on system-specified orders executed or recorded through, or otherwise reported to, BTR Trading Group, Inc. using the referenced trading system or system vendor for the stated time period. Performance statistics referenced herein represent a hypothetical model tracking account. This tracking account rises or falls based on the average per trading unit profit and loss achieved by the actual fills of client accounts when accounts are trading this system and simulated fills of this trading this system when no client accounts are actively trading it. For all trading systems, profits are not reinvested and all rates of return are 'simple returns' (non-compounded or expressed on the basis of the Recommended Account Size above). CTA returns may be compound or simple returns, please click on the CTA program listed above and read the accounting notes at the bottom of the page. Please tap or click column headings for definitions of each column in the table.

Please be aware of the following definitions fore the P&L type or type of results listed above. Results are either from a trading system or managed futures program (CTA) and may contain only hypothetical trading results, only actual trading results or a combination thereof.

Hypothetical Sys: A trading system with hypothetical trading results or with a combination of hypothetical and actual results.

Actual Sys: A trading system with only actual trading results.

Hypothetical CTA: A managed futures program from a registered CTA with hypothetical trading results or a combination of hypothetical and actual trading results. Actual CTA:> A managed futures program from a registered CTA with only actual trading results.

Hypothetical Portfolio: A portfolio consisting of trading systems, managed futures programs or a combination thereof which may contain hypothetical trading results or a combination of programs with actual trading results which may not have been traded together.

Actual dollar and percentage gains/losses experienced by investors would depend on many factors not accounted for in these statistics, including, but not limited to, starting account balances, market behavior, developer fees, incidence of split fills and other variations in order execution, and the duration and extent of individual investor participation in the specified system. While the information and statistics given are believed to be complete and accurate we cannot guarantee their completeness or accuracy. THIS INFORMATION IS PROVIDED FOR EDUCATIONAL AND INFORMATIONAL PURPOSES ONLY. These results are not indicative of, and have no bearing on, any individual results that may be attained by the trading system in the future.

The information contained in this report is provided with the objective of “standardizing” trading systems performance measurements, and it is intended for educational /informational purposes only. All information is offered with the understanding that an investor considering purchasing or leasing a system must carry out his/her own research and due diligence in deciding whether to purchase or lease any trading system noted within or without this report. This report does not constitute a solicitation to purchase or invest in any trading system which may be mentioned herein.

RISKS UNIQUE TO VIRTUAL CURRENCY TRADING PROGRAMS & SYSTEMS

For systems which trade in virtual currency derivatives, investors should note that trading in these instruments carries unique risks. One or more programs above may trade in futures contracts on virtual currencies, not actual virtual currencies which trade on spot markets. Spot markets for virtual currencies are illiquid, opaque and do not carry the same protections or oversight as US futures and securities markets. Although no program above transacts in any spot markets, risks inherent in these markets and virtual currencies will affect virtual currency futures pricing and liquidity. Investors should be aware that virtual currencies are extremely volatile, highly speculative and illiquid. The underlying value of these products relies heavily on perception and sentiment. Their legal status remains unclear and is evolving. There is no central pricing venue for virtual currencies, which may result in significantly different valuations between the spot and futures markets. Cyber attacks and other events pose significant risk to virtual currency exchanges and custodians (digital wallets) which could result in contagion across the asset class. Investors should be aware of these and other risk beyond those attendant to futures trading. Please read the NFA's Investor Advisory and the CFTC's Customer Advisory on virtual currencies before engaging a system which trades them.

NO FINANCIAL ADVICE PROVIDED: BTR TRADING GROUP MAKES NO REPRESENTATIONS AS TO WHETHER AN ALGORITHMIC STRATEGY IS APPROPRIATE FOR YOU. FURTHER, BTR TRADING GROUP MAKES NO REPRESENTATIONS OR GUARANTEES AS TO THE PERFORMANCE OF ANY ALGORITHMIC TRADING SYSTEM OR STRATEGY. THROUGH YOUR OWN SELECTION, IT IS UP TO YOU TO DECIDE WHETHER A STRATEGY IN WHICH YOU PARTICIPATE IS APPROPRIATE FOR YOU. YOU ACKNOWLEDGE THAT YOU ARE CAPABLE OF INDEPENDENTLY ANALYZING SUCH CONTENT USING YOUR OWN EXPERTISE, DUE DILIGENCE AND DECISION MAKING AND THAT YOU ARE NOT RELYING ON THIS SITE AS A BASIS FOR ANY DECISIONS YOU MAY MAKE CONCERNING INVESTMENTS.

YOU SHOULD NOT CONSIDER ANY CONTENT ON THIS SITE TO BE PROFESSIONAL INVESTMENT, TAX, TRADING OR OTHER FINANCIAL ADVICE. NOTHING ON THE SITE SHOULD BE CONSTRUED AS A RECOMMENDATION OF ANY SECURITY, FUTURES CONTRACT, COMMODITY, TRANSACTION, INVESTMENT STRATEGY, OR EXCHANGE OR MARKET BY BTR TRADING GROUP, ITS AFFILIATES OR ANY THIRD PARTY. ALL CONTENT ON THIS SITE IS IMPERSONAL AND NOT TAILORED TO THE INVESTMENT NEEDS OF ANY SPECIFIC PERSON.

General Risk Disclosure for Futures Trading: Transactions in securities futures, commodity and index futures and options on futures carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily “leveraged”. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You may sustain a total loss of initial margin funds and any additional funds deposited with the clearing firm to maintain your position. If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position. If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit.